Today, we are going to talk about how we handled our dental student loans during the coronavirus (COVID-19) pandemic

It's official. . . The coronavirus is a true pandemic and has affected the dental industry around the United States w/ announcements coming from the ADA recommending dental offices only treat emergency cases for the next couple weeks.

This has major implications for dentists / dental students with massive student debts. In this post I’m going to outline some of the ways to reduce the student loan burden over the next couple months

Lets jump right in . . .

Table of Contents

Dental School Student Loan Refinance?

I should first mention that the president recently waived interest on student loans to 0% which is the best rate that you will ever receive on your student loans.

This is meant to help students with monthly loan payments & stimulate the economy. However, this won’t last forever & I encourage everyone to seek out options for the lowest interest rate. (Click Here)

While you’ve all probably heard about the importance of refinancing loans after school, many students don’t really understand how drastically refinancing can affect their overall debt.

Loans consist of a principal amount that you signed for and an interest amount that adds up over time until you pay back the loan. Most federal loans have very high interest rates and can range from 5-7%.

This high interest adds on to the principal amount and makes it difficult to pay off the entire loan. I have some friends with interest rates close to 9%!! When I graduated dental school my highest interest rate was 6.8%.

After working for about a year I was able to refinance my loans with First Republic Bank and get all of my loans at 2.95% over 15 years. This will save me a lot of money in interest over the course of my loan.

You can even find rates that are lower than this, however, it would require you to pay back your loan over a shorter period of time (i.e. 5 or 10 years) and make your monthly payments higher.

Whatever rate you choose; just make sure your monthly payments are manageable. While refinancing is a great option, banks are not as lineate with your payment options.

For example, with your federal loans you have options for “income-based” payments. If you don’t have a job and no income, your monthly payments can become very small. However, once refinanced the banks will require your monthly payments regardless of your job situation and there are severe penalties for not paying on time.

While there are multiple companies you can refinance your loans with (Click Here), I urge you to do your research and find the company that works best for you. You should also make sure you are ready to commit to a set monthly payment.

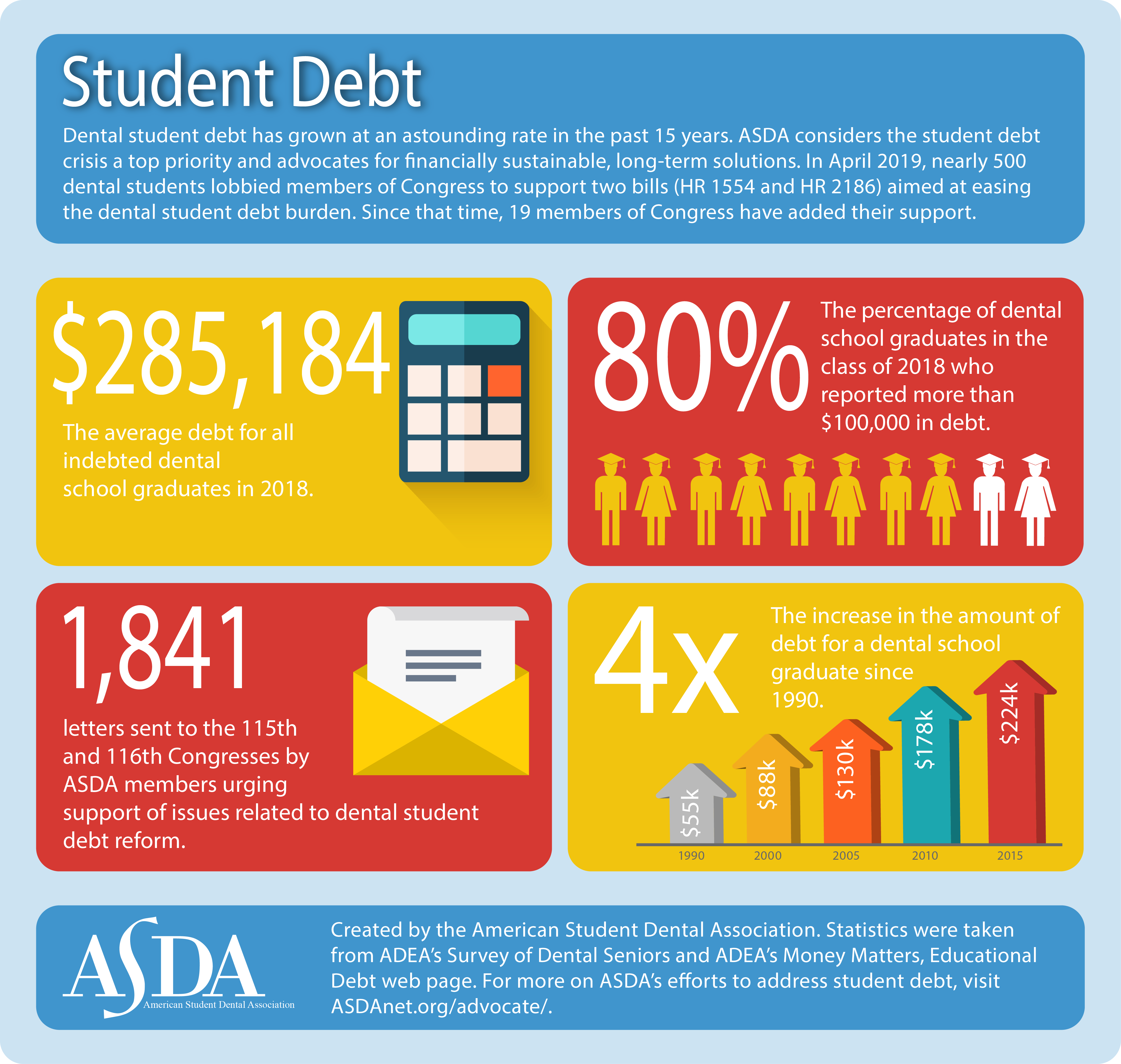

Provided by andanet.org. Click image to see source!

How to Live with Student Loan Debt?

“Live Below your Means”

While this may sound like an obvious tip, many people with large loans are doing quite the opposite. This doesn’t mean you have to eat Top Ramen every single night, but look for ways to be creative in saving your money on a daily basis.

For example, if living at home is an option for you this can save you tens of thousands of dollars a year in rent. Or consider having a roommate for a couple years to keep living costs low.

Now I’ll be the first to admit that Ashley and I love eating out and going to restaurants. But this year one of our resolutions was to not eat out during the week and pack our lunches.

Little changes to your lifestyle can add up to hundreds or thousands of dollars in your pocket.

Dental Student Loan Refinance Rates?

Another way to help increase your income is to consider multiple options for banking and do some research into which types of accounts have the highest APY.

APY stands for annual percentage yield. I honestly didn’t know much about APY until I got out of school.

I just kept my money in the bank that my family was at. However, after doing some research I found other banking options with much high APY, which means each month I’ll make more money on my existing account.

Additionally, there are multiple options for placing your money in a CD (certificate of deposit). If you have some money that you are able to place in a CD, this can allow you to get a higher return on your deposit over the course of 6 months to multiple years.

Work at a Corporate Dental Office

Many people right out of school may feel like they “have to take what they get” and since they have so much debt, feel compelled to take the first job they are offered.

While its important to start working as soon as you get your license, don’t be afraid to continue to look for jobs that offer higher income or production percentage, better benefits, or more hours/patients.

If you’re at an office that only wants you part-time, find another part-time office or search for full-time. If you’re working private practice, consider looking into part-time at a corporate office, which can sometimes offer higher pay/production percentage.

Right out of school I worked at a private office for salary, but when I wanted to increase my income I looked for a part-time job at a corporate office that could offer me a high production-based income.

Consider all of your options and don’t be afraid to ask for raises or a production percentage. It’s important when interviewing to ask about options for production pay if not initially offered because in a busy office this can greatly increase your income.

Dental Student Loan Forgiveness

There are many options out there for dental loan forgiveness if you’re willing to work in certain areas or states. While this may not be a viable option for everyone, consider working in certain areas for a couple years to help get your loans to a manageable amount or paid off.

There are also loan forgiveness options available if you treat certain types of insurance patients in your office. For example, in California there are grants available to dentists and physicians that see Medi-Cal/low-income patients. Look for similar opportunities offered in your state of practice. (Click Here)

That's it!

This is all you need to start taking incredible dental photos at your practice today. Purchasing proper dental photography equipment has changed the way I practice dentistry & is a must for anyone trying to elevate their dental career. The next section is dedicated to specialized accessories to aid in your photography techniques

Full disclosure: I receive a commission if you purchase the dental products through my referral links. This helps me run this blog & I appreciate the support.