I graduated dental school with over $200,000 & I want to share with you some tips that helped me when deciding to refinance my loans.

If you are reading this blog post, then I would have to assume that you are a student with a MASSIVE amount of student loans.

Debt can be incredibly burdensome but if you empower yourself with some basic financing knowledge, there are ways to make these loans less cumbersome.

Today, we are going to review the best ways to consolidate & refinance your student loans

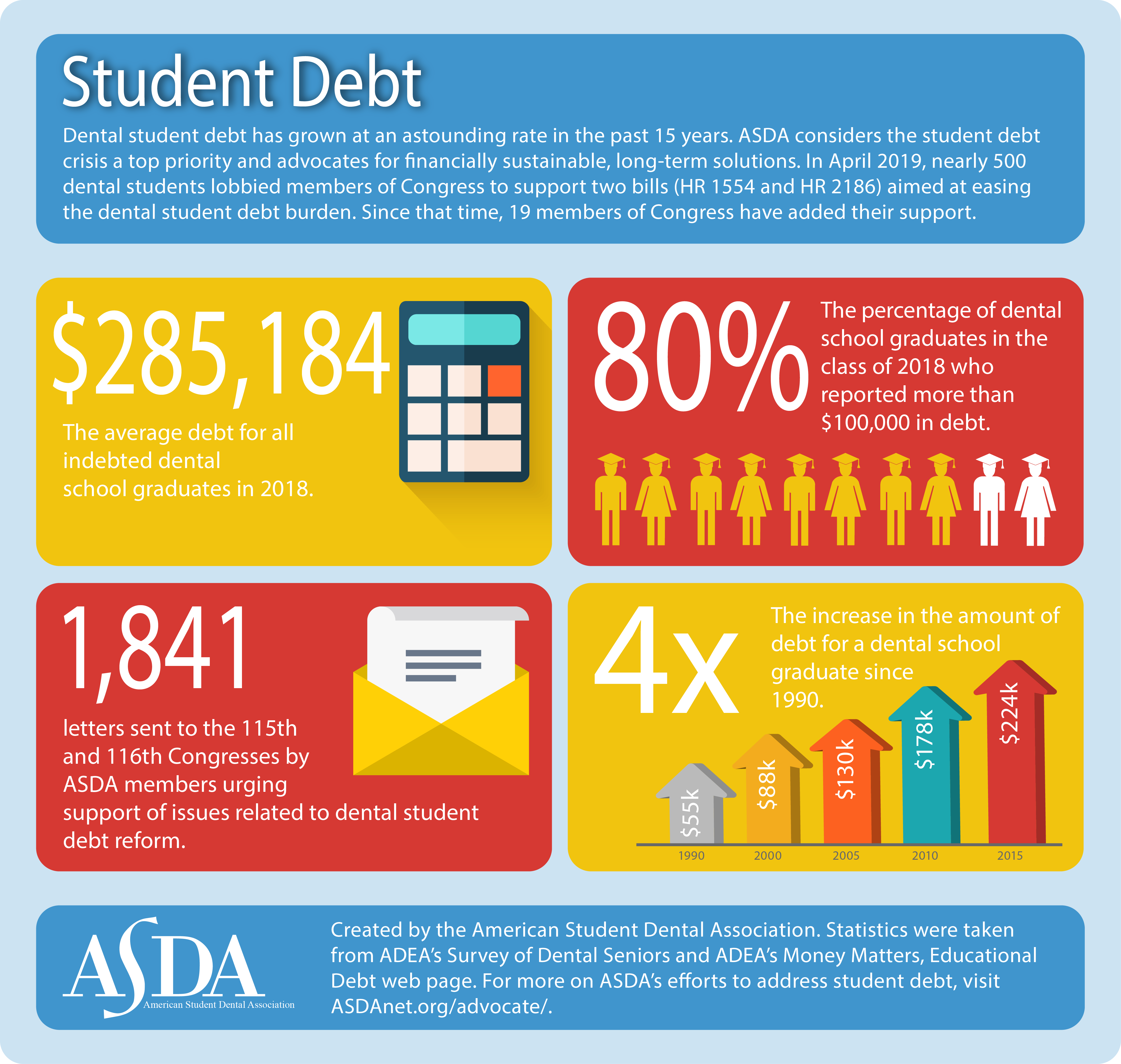

What is the Average Dental Student Debt?!

The answer may surprise you . . . .

According to the American Student Dental Association, the average debt for all indebted dental school graduates in 2018 is $285,184. That is an insanely high amount of debt even for a profession who's median salary in the U.S. comes to approximately $151,440. The amount of debt for a dental school graduate since 1990 has increased by 4x.

so, how are we supposed to pay off these loans. . .

provided by andanet.org

How I Refinanced my Student Loans at 2.95% Fixed APR

Immediately after graduation, I didn't have any clue what I was going to do with all the debt that accumulated over the years of dental school.

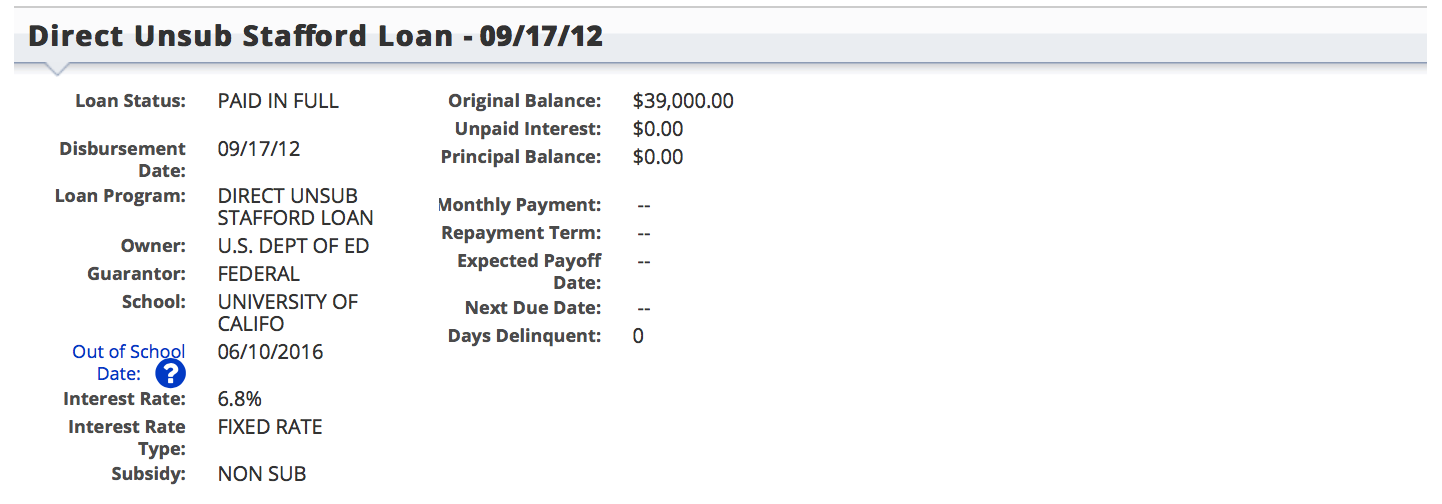

I had a variety of federal loans that varied in interest rates. I decided that I would focus on finding a stable job & start to pay off some of the loans with higher interest rates (~7%)

After a year, I decided to more seriously consider ways to reduce my debt. I became more financially knowledgeable & realized how crippling the interest can be on a loan over $100,000.

At the time, my sister recently graduated as an architect from New York; we both teamed up to find the lowest refinance rates out there.

There are an incredible number of lenders out there that will help eliminate student loan debt. Some of the best refinance lenders are companies like Laurel Road, Earnest & Sofi. They have great reputations & have helped many dental & medical students in the past.

As we searched for the best rates, we came across a company that we had never heard before called First Republic Bank (Message Me).

Student loan rates are constantly changing but at the time (2017) this bank was offering the lowest fixed APR.

Fortunately, I was able to consolidate & refinance $220,000 with a Fixed APR of 2.95% for 15 years. I had the option to achieve a lower interest rate with a 5 or 10 year plan; however, I wanted to reduce the monthly cost in order to save for other investments in the future.

Want to see the interest rates. . . Click Here

Why Should You Refinance Student Debt?

So you may be asking yourself if its really necessary to refinance your loans. . .

The main reason to refinance student loans is to reduce the incredibly high federal interest rates applied to your loans. I have included a chart which highlights the interest Rates for Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans first disbursed on or after July 1, 2019 and before July 1, 2020. . .

LOAN TYPE | 10 YEAR TREASURY NOT HIGH YIELD | ADD ON | FIXED INTEST RATES |

|---|---|---|---|

Direct Subsidized Loans and Direct Unsubsidized Loans for Undergraduate Students | 2.479% | 2.05% | 4.53% |

Direct Unsubsidized Loans for Graduate and Professional Students | 2.479% | 3.60% | 6.08% |

Direct PLUS Loans for Parents of Dependent Undergraduate Students and for Graduate or Professional Students | 2.479% | 4.60% | 7.08% |

JOIN OUR EMAIL TIPS

Sharing Our Journey To Practice Ownership (Tips & Tricks)

What About Dental Loan Forgiveness

There are a variety of other ways to reduce the burden of student loans. Some of these include Public Service Loan Forgiveness (IDR), Health Professions Scholarship Program (HPSP) & Dentists Loan Repayment Act Program (LRP). Let's go over each option:

Public Service Loan Forgiveness (IDR)

This option is reserved for those that are willing to work for a government or non-for-profit organization for 10 years. The program will forgive the remaining balance of your loans if you follow all requirements of the program. Some of the requirements are listed below:

Work for Qualifying Employer:

- Government organization

- 501 (c)(3) Organization

- Not-for-profit organization

Work Full Time:

- Work approximately 30 hours / week

- More information found here

In addition, you must be making payments under qualifying IDR (Income Driven Repayment Plan).

These plans are for student loans and base the monthly payment on a combination of income & family size.

If you have large student loans then you are more likely to have a remaining loan balance after 10 years which will then be forgiven.

The plans include the following:

- The Revised Pay As You Earn (REPAYE) Plan

- The Pay As You Earn (PAYE) Plan

- The Income-Based Repayment (IBR) Plan

- The Income-Contingent Repayment (ICR) Plan

You can find more information about the repayment plans here:

Health Professions Scholarship Program (HPSP)

This program is reserved for professional students that are willing to join the Army, Navy, and Air Force in return for a service scholarship.

It is an incredible way to pay off student loans as you will receive full coverage of all tuition/fee charges and reimbursement of health insurance costs.

Some programs offer signing bonuses and month living stipends which will cover approximately $2,000 per month.

After school is done, students, must serve in the branch of service that they were accepted into. . .

You can find more information about the repayment plans here.

Dentist Loan Repayment Act Program (LRP)

Some states have a specific repayment program.

California has a program dedicated to increase the number of dentists/physicians serving MediCal beneficiaries in underserved communities across the state.

The Budget act of 2018 appropriated $220,000 for the Proposition 56 Medi-Cal Physicians and Dentists Loan Repayment Act Program (LRP).

Eligible physicians and dentists are able to receive a loan repayment of up to $300,000 in exchange for a 5 year service obligation to Medi-Cal beneficiaries.

The awardees must follow certain requirements including maintaining a patient caseload percentage of 30% over the course of 5 years.

More information on this program can be found here.

How To Refinance Dental School Debt (Step by Step)

This next section will give you all the tools required to help you refinance your student loans. I have specifically mentions dental school in the title; however, this applies to anyone with massive student loans.

Here are some of lenders that have the lowest rates for students:

Unfortunately, rates are continuously changing every year so it is critical that you apply to each lender to find the best rate for your student loan.

It takes only a couple minutes at each site to see whether your dental student loan qualifies for refinancing.

After receiving a pre-qualified rate, the lenders will ask for additional information such as proof of income.

You can typically submit this proof of income through pay stubs or tax returns. This is why you typically need to work for 6 months to 1 year prior to applying for refinancing.

Sometime during this process they will ask for a credit check

It takes approximately 2-3 weeks prior to finalizing this process & then you can enjoy a much lower percentage then what the government typically offers

The Problems with Private Student Loan Lenders

Not everything is butterflies and roses. When you consolidate your loans you have to remember that you are taking yourself out of the government student loan program which actually has a variety of benefits.

Recall that you can switch to Income Driven Repayment Plans. If something unfortunate happens at work (ex. injury, fired from your job, can't find a job). The government is typically more forgiving than a private lender which will expect a payment every single month.

If you miss a payment, the penalty can be severe depending on the student loan lender that you decide to go with. Accordingly, choose a payment plan that is reasonable & accounts for unforeseen circumstance that could happen in your life.

The Best Dental Student Loan Lenders in 2020

What are the best student loan lenders for doctors with high debt in 2020? I have compiled a table that provides information on interest rates. The best things to do is compare all companies and then make a decision. Our referral link offers a cash back bonus so please consider using our links when making the decision -

Lender | Cash Back | Interest | Price |

|---|---|---|---|

EARNEST | $200 | Variable 1.99% - 6.89% Fixed 3.20% - 6.99% | |

LAUREL ROAD | $200 | Variable 1.99% - 6.65% Fixed 3.50% - 7.02% | |

SOFI | $200 | Variable 2.01% - 8.88% Fixed 3.49% - 8.36% |

CONCLUSION

Dental student loans need to be refinanced in order to lower your interest rate. Make sure to visit different lenders to find the best refinancing rate available to you. This will take time but can save you tens of thousands of dollars as you grow in the future.

I appreciate your time reading this blog post and have an awesome day!