I've heard countless stories of new dentists (my friends) who are trapped in a horrible lease agreement or are investing more money then they can afford in a dental office space . . .

When starting your own dental practice some of the first questions you most likely ask yourself will be about location, acquisition versus start-up, and lease versus buy. . .

When we first decided to build a new office, one of the first decisions we had to make was should we lease again or buy?

This was a huge decision and both options have their pros and cons. . .

Today, I’m going to review some of the differences between lease versus buy so you can make the right decision for you. . . .

Should I Buy or Lease a Dental Office?!

The short answer (for those that don't like to read. . .)

The decision to buy or lease comes down to individual preferences and the right choice for you will likely depend on where you are currently at in your career and financial situation. . .

Purchasing is a good option if your goal is to build equity and want to opportunity to sell in the future. However, you also need to have enough available cash for a down payment, mortgage and property upkeep. .

Leasing may be a better option if you aren’t ready to commit to a location. or want to have less property maintenance costs. However, you need to be prepared for increased rent prices. . .

I recommend talking to experts such as your accountant, real estate broken, and/or attorney to help make the right decision for you.

now, let's get to the good stuff . . .

7 BENEFITS TO BUYING A DENTAL OFFICE

1. Equity

2. Appreciation

3. Stability

4. Fixed Overhead

5. Tax breaks

6. Rental Potential

7. Control

#1 EQUITY

• Equity is essentially the amount you actually own of a piece of property. As you pay off the principal loan and interest, your equity or amount of ownership will increase.

• Equity is an asset that you can sell in the future or borrow against.

• When you lease a dental office, you don’t get any ownership in the property or accumulate equity. Thus, you can’t take advantage of capital appreciation.

• Sometimes, people may rent for 20-30 years with no benefits of increased equity, but they could’ve owned the property by then.

#2 APPRECIATION

• Appreciation is the increase in value of an asset (property) over time. This occurs due to changes in inflation and interest rates over time and/or increase in demand.

• Commercial real estates tend to appreciate over time, which means you can sell the property in the future for a profit.

#3 STABILITY

• Many dental offices have specific equipment and fixtures that are difficult and expensive to move once installed. If you buy a property, you don’t have to worry about your landlord renewing your lease.

• If your lease isn’t renewed you could have large charges to move equipment. Additionally, some leases could require you to return the space to its original condition.

#4 FIXED OVERHEAD

• When owning a dental office space, your mortgage is a fixed rate you agree to.

• A rent payment can increase over time and when renewing your lease you can’t guarantee the same terms.

• Additionally, many times a monthly rent payment will be the same or higher than a monthly mortgage payment. Some lease agreements will require you to pay monthly retail insurance, maintenance costs, and/or property taxes. . . When added to the lease payment, your monthly payments can be extremely high. However, every lease agreement is different.

#5 TAX BREAKS

• Both buying and leasing have different tax breaks and when deciding which could benefit you more, its best to consult your accountant.

• With dental office ownership your interest, depreciation, and mortgage-related expenses on the property are tax-deductible. However, you can not deduct the mortgage payment itself.

WHAT IS DEPRECIATION?!

- A depreciating asset is an “asset that has a limited effective life and can reasonably be expected to decline in value over the time it is used.”

- Type of depreciable assets include: buildings, machinery, vehicles, computers, certain office equipment, furniture

- These depreciation deductions can be spread out over a number of years

• With leasing you can deduct the entire monthly lease payment and ongoing costs such as utilities and mantenance, property insurance/taxes

#6 RENTAL POTENTIAL

• If you are the owner of a property you have the opportunity to rent either the entire space or portions of the space to tenants for rent.

• This is a potential passive income source. With renting you lose this potential for seconday income.

#7 OFFICE CONTROL

• You have control over the space (within the limits of zoning restrictions).

• If you want to reconfigure the space you don’t have to get permission form a landlord

7 CONS TO BUYING A DENTAL OFFICE

1. Higher initial investment

2. Liabilities

3. Capital loss potential

4. Upkeep costs

5. High rates in competitive real estate markets

6. Lack of flexibility

#1 HIGHER INITIAL INVESTMENT

• When purchasing you have to make a substantial down payment. You need to have enough cash on hand and be able to have a large amount of cash be tied up.

• There are also closing costs and due diligence fees

• For a $1 million property, you can expect to may minimum $100,000-150,000 for the down payment

• With a lease, typically there is no down-payment and lower upkeep costs

• You then have more cash at hand to use for other investment

#2 OFFICE LIABILITIES

• You are responsible if someone is hurt on your property

• Have to pay for liability insurance

• If you rent part of property, you are also liable as the property manager

#3 CAPITAL LOSS POTENTIAL

• Always a chance that the property’s value will go down and then you take a loss when selling

• While commercial real estate generally goes up in value, there is no guarantee that value doesn’t decline

#4 OFFICE UPKEEP COSTS

• Property costs are your responsibility

• Responsible for property taxes, insurance, repairs and maintenance

• Specifics of a lease can differ, but typically with a lease you don’t have to pay for significant maintenance/repairs. This makes it easier to budget.

#5 HIGH RATES IN REAL ESTATE MARKETS

• Depending on the location you want to start your business, you may not be able to afford the property

• Competitive areas will have more expensive real estate and thus require high down payments

• With leasing you may be able to afford the payments in the area you desire and get into a strategic location that you wouldn’t be able to afford buying.

#6 LACK OF FLEXIBILITY

• A mortgage can tie you down to one location and a chunk of your money is also tied up

• If you want to use that money you would have to sell property or do a partial cash-out refinance

• Tied up money could have been used for other investments/opportunities

• With leasing you can choose to move or stay when your lease agreement is up.

CONCLUSION

The decision to buy or lease comes down to individual preferences and the right choice for you will likely depend on where you are currently at in your career and financial situation. . .

Purchasing is a good option if your goal is to build equity and want to opportunity to sell in the future.

However, you also need to have enough available cash for a down payment, mortgage and property upkeep. . .

Leasing may be a better option if you aren’t ready to commit to a location. or want to have less property maintenance costs. However, you need to be prepared for increased rent prices.. .

I recommend talking to experts such as your accountant, real estate broken, and/or attorney to help make the right decision for you.

While we decided to purchase our new space, our current space had been under lease and this has worked out for the business for many years

However, my mother has been at the same location for over 30 years and has paid rent for 30 years! In retrospect if she had bought the space she could’ve owned it by now. Thus, we decided to invest in purchasing our new space to help build our future equity. . .

Of course this depends on a lot of factors, however, since we love the location and don’t plan on moving our office in the future, purchasing turned out to be the best decision for us. . .

CHECK OUT OUR OFFICE RESOURCES BELOW

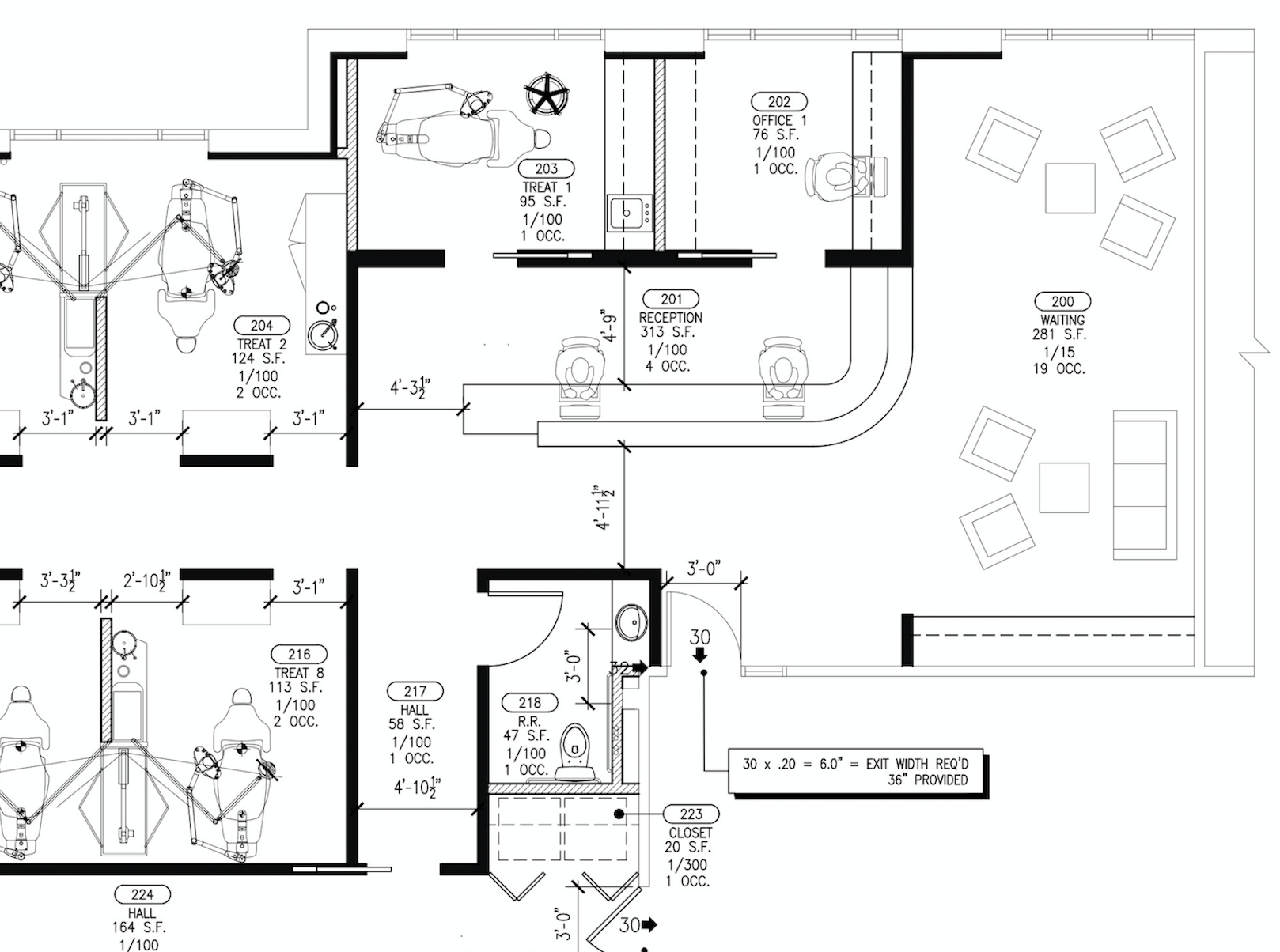

Get Access to

Our Office Floor Plan

Check out our office floor plan and join our journey to practice ownership. We will be sharing what we learn for FREE as we grow the practice